The Ultimate Indian FinTech Showdown (2025): A Head-to-Head Battle of UPI, BNPL, and Neobanks

By Amandeep Singh

Founder, CancelMates. Decoding the future of money in India.

Unlock your phone. How many finance apps do you see? There’s probably a UPI app like Google Pay, maybe a BNPL (Buy Now, Pay Later) service like Simpl, and perhaps you’ve been tempted by a slick Neobank like Jupiter or Fi. Welcome to the chaotic, brilliant, and utterly confusing world of Indian FinTech in 2025.

Each app promises to simplify your financial life, but together they create a digital clutter that leaves most of us wondering: Which of these tools do I actually need? Are Neobanks just a fancy wrapper on a traditional bank? Is BNPL a smart credit tool or a debt trap in disguise? And which UPI app is genuinely the best, now that the "good ol' days" of massive cashbacks are over?

Forget the generic lists. It's time for a definitive showdown. We're pitting the three titans of Indian personal finance-UPI, BNPL, and Neobanks-against each other in a head-to-head battle. We'll break down their real-world use cases, compare the biggest players directly, and declare the ultimate winner for your wallet.

The FinTech Showdown: An In-Depth Guide

1. Meet the Contenders: Understanding the Players

Before the battle begins, let's get to know our three fighters.

The Champion: UPI (Unified Payments Interface)

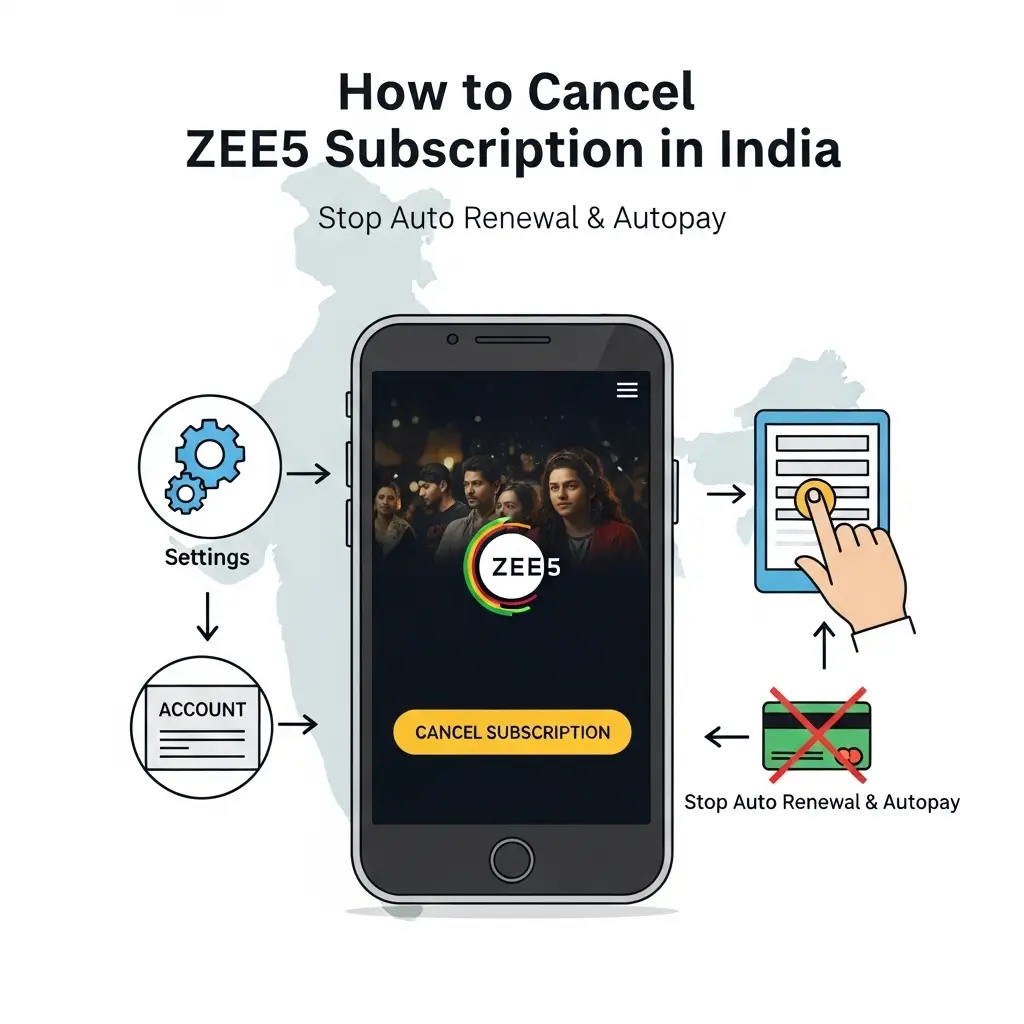

The undisputed king of digital payments in India. UPI allows instant, free bank-to-bank transfers, but its real power lies in managing recurring payments, a process we explain in our guide to cancelling UPI AutoPay mandates.

Key Players: Google Pay, PhonePe, Paytm, CRED.

Superpower: Unmatched convenience for daily transactions.

The Challenger: BNPL (Buy Now, Pay Later)

The new-age credit provider. BNPL lets you purchase items instantly and pay for them later, usually in interest-free installments. Getting started is easy, but as we detail in our complete guide to using BNPL safely, it's a tool that requires discipline.

Key Players: Simpl, LazyPay, Slice, PostPe.

Superpower: Instant, frictionless credit for small to mid-sized purchases.

The Revolutionary: Neobanks

Digital-only banks that offer a full banking experience through a slick mobile app, without any physical branches. They are not banks themselves but technology layers on top of traditional banks.

Key Players: Jupiter, Fi Money, NiyoX.

Superpower: Superior user experience and smart money management tools.

2. The Head-to-Head Battle: Real-World Scenarios

Let's see how our contenders perform in everyday financial situations.

| Scenario | UPI | BNPL | Neobank | Winner |

|---|---|---|---|---|

| Daily Spends (Chai, groceries, auto rides) | Flawless. Instant, universal QR code acceptance. | Clunky. Not all small vendors accept BNPL. | Good, as it uses its own UPI handle, but it's still just UPI. | 🏆 UPI |

| Mid-Sized Online Shopping (₹5,000 shoes on Myntra) | Simple, but debits your account immediately. | Excellent. Pay in 3 interest-free installments, easing the burden on your wallet. | Just another payment method. | 🏆 BNPL |

| Managing Your Monthly Salary (Tracking spends, setting goals) | No real features for this. | Irrelevant for this use case. | Excellent. Auto-categorizes spends, creates visual reports, and offers "Pots" or "Jars" for goal-based saving. | 🏆 Neobank |

| Building a Credit Score | No impact. | ⚠️ Risky. While some BNPL services report to credit bureaus, missing a payment can severely damage your CIBIL score. Often registered as a personal loan. | Minimal impact. It's a savings account, not a credit product. | 🏆 None (A Traditional Credit Card is the winner here) |

3. Tale of the Tape: The Mini-Showdowns

Now let's zoom in and compare the biggest players within each category.

UPI Battle: Google Pay vs. PhonePe

The two giants that own the UPI market. The cashback war is over, so the real difference is user experience.

Winner: Google Pay for User Experience, PhonePe for Reliability.

BNPL Battle: Simpl/LazyPay vs. Slice

After RBI's crackdown, the BNPL space changed. Here's the 2025 reality.

Winner: Simpl/LazyPay for everyday convenience, Slice for a modern alternative to a traditional credit card.

Neobank Battle: Jupiter vs. Fi Money

The two darlings of the Neobank world, both built on top of Federal Bank. The choice is purely about the experience layer.

Winner: A tie. Jupiter for simplicity, Fi for power users.

4. The Final Verdict: Building Your Ultimate FinTech Stack

The showdown reveals a clear truth: there is no single winner. Each of these tools is a specialist, not a generalist. The real victory lies not in choosing one, but in building a smart, lean "FinTech Stack" that leverages the best of all three.

The Ultimate FinTech Setup for a Young Indian Professional in 2025:

1. Your Primary Salary Account (A Traditional Bank - HDFC, ICICI, SBI)

This is your anchor. Your salary gets credited here, and it's your go-to for large transactions, loans, and building a long-term banking relationship. Don't ditch it.

2. Your Go-To UPI App (Google Pay)

Link your traditional bank account to Google Pay for all your daily, instant payments. Its clean UI makes it the best choice for this task.

3. Your Expense Management Hub (Jupiter or Fi)

Open a Neobank account and use it as your secondary "spending" account. Transfer a fixed amount here each month for your discretionary expenses. The app will automatically track and categorize your spends, giving you powerful insights into your financial habits without cluttering your main bank statement.

4. Your Strategic Credit Tool (Simpl or a Traditional Credit Card)

Use a service like Simpl for small, frequent online orders to keep them off your main statement and pay in one go. For building credit score and larger purchases, a traditional credit card is still the most powerful tool. For a deeper analysis of the options, refer to our definitive BNPL guide.

5. The Ultimate FAQ: Every Question, Answered

Q: Are Neobanks safe? Is my money at risk if they shut down?

A: Your money is safe. Neobanks in India are not banks themselves; they are technology platforms partnered with RBI-licensed banks (like Federal Bank for Jupiter and Fi). Your money is held with the partner bank, so it is insured and secure even if the Neobank app company fails.

Q: What's the real difference between BNPL and a Credit Card?

A credit card offers a revolving line of credit for all types of purchases and helps build your credit score when used responsibly. BNPL offers short-term, interest-free installment plans for specific, often smaller, purchases, a topic we explore in our showdown of the top 5 BNPL apps. Missing a BNPL payment can negatively impact your credit score, often more harshly than a credit card, as it can be reported as a personal loan default.

Q: Is there any alternative to UPI?

A: While UPI is dominant, other digital payment methods exist. IMPS (Immediate Payment Service) offers real-time transfers through net banking and mobile banking apps, and has been around for longer. However, for sheer convenience and universal merchant acceptance, UPI is unparalleled in India.

Q: Why should I use a Neobank if my traditional bank app has UPI and spend tracking?

A: While traditional bank apps are improving, Neobanks are built from the ground up for a superior mobile user experience. Their spend tracking is usually more intuitive, automated, and visually insightful. They are excellent as a secondary "expense account" to keep your primary salary account statement clean and easy to manage.