How Subscriptions Are Silently Damaging Your CIBIL Score (And the 2025 Guide to Fix It)

By Amandeep Singh

Founder, CancelMates. Decoding the hidden costs of the subscription economy.

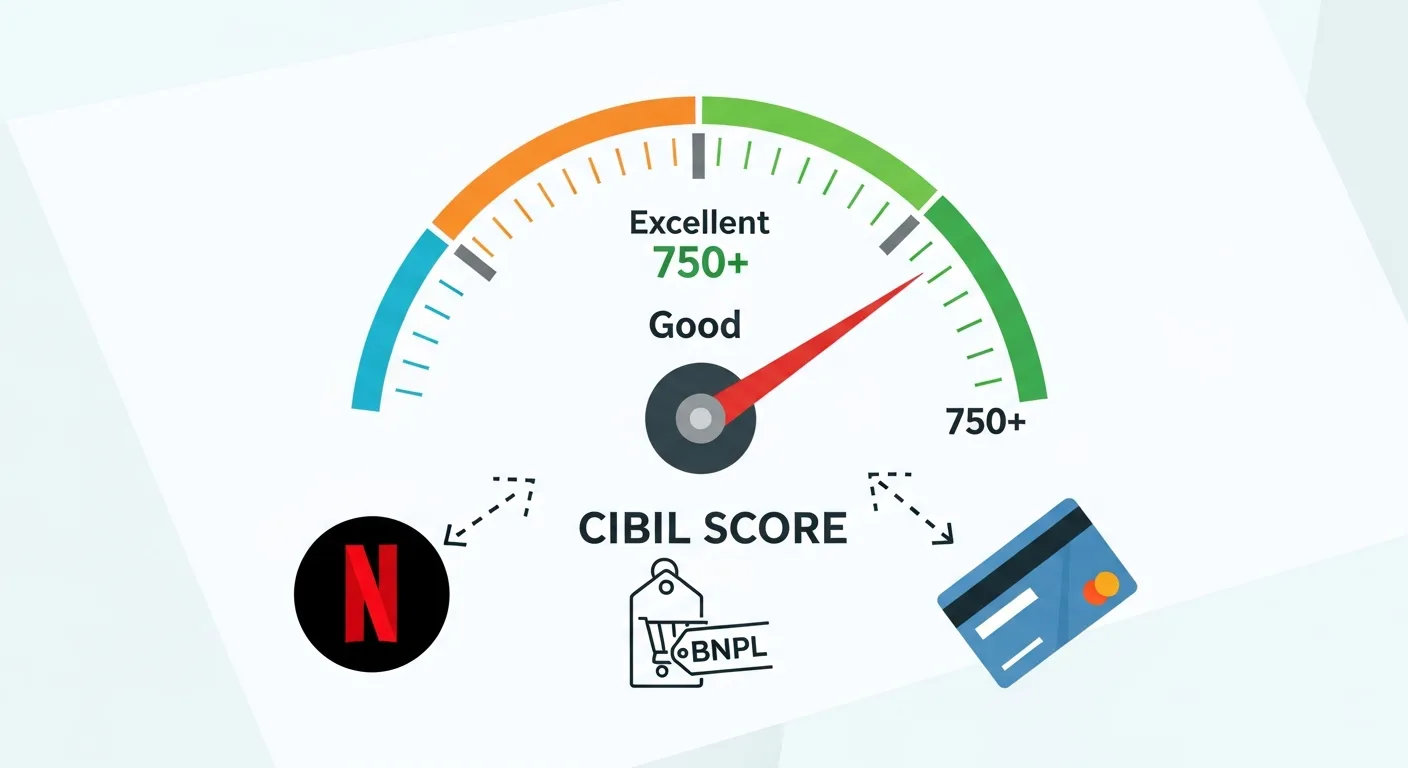

One missed payment. A few hundred rupees for a service you barely use. No big deal, right? Wrong. A few weeks later, your application for a new credit card or a much-needed personal loan is rejected. The reason? A quiet, devastating hit to your CIBIL score that nobody warned you about.

Welcome to the new reality of personal finance in India. In the age of one-tap subscriptions, UPI AutoPay, and Buy Now, Pay Later (BNPL), your smallest financial habits are being watched, tracked, and judged. That forgotten Zomato Gold renewal or the maxed-out credit card from a dozen small subscriptions-they are all leaving a digital footprint on your financial reputation. It's no surprise that a recent TransUnion CIBIL report found 119 million Indians are now actively checking their scores-a 51% year-on-year jump.

This is the unfiltered guide to understanding how the modern subscription economy is silently damaging your CIBIL score. We'll expose the real culprits and give you a step-by-step 2025 action plan to take back control.

Your CIBIL Score Rescue Plan

- 1. The Myth vs. Reality: Do Subscriptions Directly Affect Your Score?

- 2. The 3 Silent Killers Destroying Your Score

- 3. The 2025 Action Plan: Your 4-Step CIBIL Rescue Mission

- 4. Bonus: Is a Paid CIBIL Subscription Worth It?

- 5. The Ultimate Defense System for Your Score

- 6. The Ultimate FAQ: Every Question, Answered

1. The Myth vs. Reality: Do Subscriptions Directly Affect Your Score?

Let's be clear: Paying for Netflix with your debit card does not impact your CIBIL score. The damage isn't from the subscription itself, but from how you pay for it and what happens when you fail to pay. It's the financial instruments you use-Credit Cards, BNPL, and EMIs-that are the bridge to your CIBIL report.

2. The 3 Silent Killers Destroying Your Score

Silent Killer #1: The Buy Now, Pay Later (BNPL) Trap

This is the biggest new threat. When you use services like Simpl or LazyPay, you're taking out a small, short-term loan. A single missed payment can be reported as a default. Adhil Shetty, CEO of BankBazaar.com, notes that a single missed EMI can lower your score by 50-100 points.

Silent Killer #2: The Auto-Debit Betrayal

As one LinkedIn user discovered, auto-debit is not foolproof. A technical glitch can cause the payment to fail on the due date. Even if the bank retries and succeeds later, the initial failure is often reported to CIBIL as a default. You are penalized for a failure that wasn't your fault.

Silent Killer #3: Death by a Thousand Swipes

Putting all your small subscriptions on one credit card can cause two problems: consistently high credit utilization (over 30% of your limit), which signals you are "credit-hungry," and the temptation to pay only the minimum due, trapping you in a high-interest debt cycle. Both will steadily lower your score.

The 2025 Action Plan: Your 4-Step CIBIL Rescue Mission

Step 1: Conduct a CIBIL Audit & Find the Damage

First, let's bust a huge myth from Reddit: checking your own CIBIL score does NOT lower it. This is a soft inquiry and has zero impact. It is your right and your duty to check it.

Action: Get your free, official CIBIL report to find any late payments from BNPL apps or failed auto-debits you weren't aware of.

The Best FREE Ways to Check Your CIBIL Score:

- Directly from CIBIL: You are entitled to one free, full credit report from the official CIBIL website each year.

- Via Your Banking/UPI App: Most major apps, including Google Pay, Paytm, and many banking apps, have a built-in feature to check your CIBIL score for free, refreshed monthly. This is the easiest and safest method.

- Third-Party Apps: Services like OneScore are dedicated to providing free, regular credit score updates.

Note: We do not use affiliate links for these. Our only goal is to point you to the safest and most effective tools.

Step 2: Tame Your BNPL & Subscription Habits

Treat every "Pay Later" transaction as a real loan.

Action: Consolidate your BNPL usage to one, maximum two, apps. Set calendar reminders for the due dates or, better yet, pay them off within a few days. For regular subscriptions, use a debit card or UPI instead of BNPL to keep them off your credit report entirely.

Step 3: Master Your Auto-Debits

"Set it and forget it" is dangerous. Change your mindset to "Set it and verify it."

Action: The day after your EMI or credit card auto-debit is due, log in to your loan/card account and confirm the payment was received. If it failed, pay it manually online the same day.

Step 4: Optimize Your Credit Card Strategy

Use your credit card as a payment tool, not a loan.

Action: Set up auto-debit for the "Total Amount Due," not the "Minimum Amount Due." To keep your credit utilization low, make a mid-cycle payment before your statement is generated.

Step 5: Graduate from Risky BNPL to a Real Credit-Builder

You've now learned how to fix the damage. The final step is to build a smarter system for the future. Relying on multiple, small-time BNPL services is one of the fastest ways to accidentally damage your CIBIL score. It's time to consolidate.

This is where a modern credit card like Slice becomes a powerful solution. Unlike traditional BNPL, Slice operates as a proper credit card, which means every on-time payment you make is a positive signal that helps to actively build and repair your CIBIL score. It gives you the flexibility of credit with the discipline of a single monthly bill.

Bonus: Is a Paid CIBIL Subscription Worth It?

Many financially savvy Indians swear by the paid CIBIL subscription (around ₹1200/year). Is it an unnecessary expense or a valuable tool?

The Argument FOR It:

You get real-time alerts for any changes to your report, including hard inquiries or new accounts. This is your first line of defense against fraud and reporting errors. As one user noted, it helped them catch a bank that failed to report their loan correctly, and they got it fixed in two days instead of 30.

The Argument AGAINST It:

For most people with simple finances (1-2 credit cards, no major loans), the free monthly refresh available on various apps is more than enough. The paid subscription is an overkill unless you are actively managing multiple loans or are paranoid about your score.

Verdict: It's a peace-of-mind purchase. If you have complex credit or high anxiety about it, it's worth it. For everyone else, the free monthly check is sufficient.

The Ultimate Defense System for Your CIBIL Score

Fixing the damage is one thing. Ensuring it never happens again is victory. The CancelMates app is your free early-warning system. We track all your subscription due dates and UPI mandates, sending you reminders before a payment is due, so you never have to suffer a surprise CIBIL hit again.

Protect Your CIBIL Score for Free6. The Ultimate FAQ: Every Question, Answered

Q: Do subscriptions like Netflix or Spotify directly affect my CIBIL score?

A: No. The subscription service itself does not report to CIBIL. However, how you pay for it does. If you miss a payment made via a BNPL service or it contributes to a late credit card payment, that will affect your score.

Q: I missed a BNPL payment by one day. How bad is the damage?

A: The damage can be significant. Even a single day's delay can be reported as a default, potentially dropping your score by 50-100 points. It's crucial to treat BNPL due dates with the same seriousness as a loan EMI.

Q: My bank manager told me checking my CIBIL score frequently will lower it. Is this true?

A: This is a common and dangerous myth. Checking your own score is a soft inquiry and has zero impact on your score. It is only when a lender checks your score for a loan application (hard inquiry) that your score might dip slightly. You should absolutely check your own score regularly.

Q: Can paying for subscriptions help build my credit score?

A: Yes, indirectly. If you consistently pay for your subscriptions using a credit card and then pay that credit card bill in full and on time every month, you are demonstrating responsible credit behavior. This positive payment history is the most important factor in building a high CIBIL score.