The Ultimate 2025 Guide to Mastering Your Subscriptions in India (And Stopping Unwanted Payments)

By Amandeep Singh

Founder, CancelMates. On a mission to put money back in your wallet.

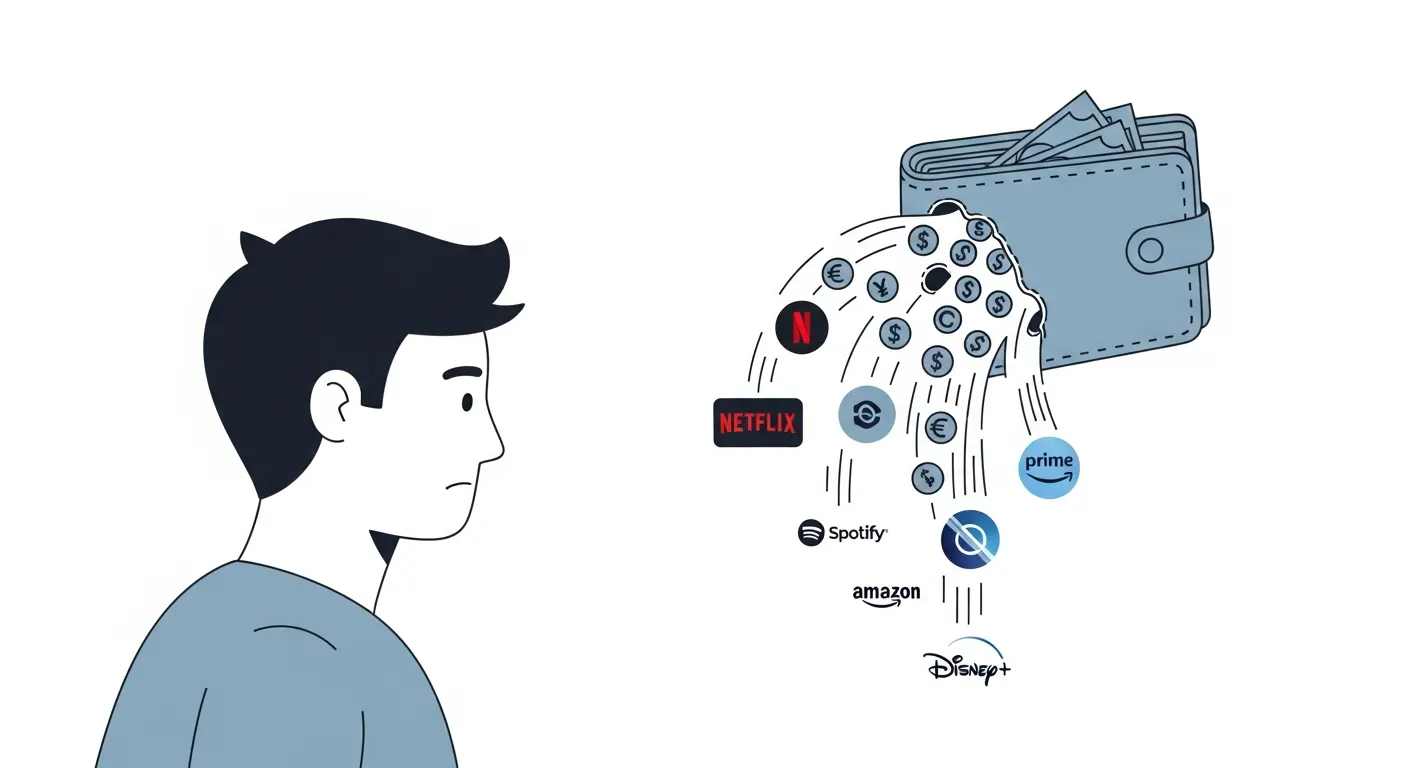

₹499 for a streaming service you forgot about. ₹129 for a "risk-free" trial that auto-renewed. ₹999 for a yearly plan you never meant to continue. These are not just small charges; they are silent leaks in your financial boat, draining your hard-earned money month after month.

In the booming Indian subscription economy, convenience has a hidden cost: forgetfulness. Companies are banking on your inattention. They've designed systems-from confusing UPI mandates to impossible-to-find cancel buttons-to make it easy to sign up and a nightmare to leave. But it's time to take back control.

This is your master playbook. By the end of this guide, you will have a complete, step-by-step system to find, audit, and manage every single recurring payment in your life. This is your toolkit to plug every leak for good.

Your Subscription Management Battle Plan

Part 1: Know Your Enemy - The Four Types of Subscription Traps

Companies use sophisticated psychological tricks, known as "dark patterns," to keep you paying. Here are the four most common traps you'll encounter in India.

The Free Trial Trap

This is the classic bait-and-switch. A "risk-free" trial requires your card or UPI details upfront and is designed to automatically convert into a paid plan, banking on your forgetfulness. Read our full guide on beating the Free Trial Trap in India.

The UPI AutoPay Ambush

Approving a UPI mandate is a one-tap process, but finding and cancelling it is a maze. The mandate could be in GPay, PhonePe, Paytm, or your bank's app, making it incredibly easy to lose track of what you've authorized. Here's our complete guide to finding and cancelling every UPI AutoPay mandate.

The "Roach Motel" Subscription

This dark pattern makes it easy to get in, but nearly impossible to get out. Think of gym memberships that require an in-person visit to cancel, or services that force you into a long call with a retention specialist. See our list of the hardest subscriptions to cancel (and how to fight back).

The Forgotten Service

The most common trap of all. You sign up for a service like Amazon Prime for a sale, or an OTT for a single cricket series, and then simply forget about the yearly renewal. These are the silent killers of your budget. Check out the top 10 subscriptions Indians forget to cancel.

Part 2: The Audit - Your 3-Step Plan to Find Every Leak

It's time to become a financial detective. Set aside one hour and follow this action plan to create a master list of all your recurring payments.

Step 1: The Bank Statement Sweep

Log in to your primary bank and credit card accounts online. Download the last 3-6 months of statements. Open the PDF and use the search function (Ctrl+F) to look for keywords like "subscription," "renewal," "auto-debit," and the names of popular services (e.g., "Netflix," "Amazon," "Spotify"). Add every recurring charge you find to a list.

Step 2: The App Store Deep Dive

Many subscriptions are billed directly through your phone's app store. This is a crucial second place to check.

• On iPhone/iPad: Go to Settings > [Your Name] > Subscriptions.

• On Android: Open the Google Play Store > [Profile Icon] > Payments & subscriptions > Subscriptions.

Compare this list with your bank statement list and add any new ones. Follow our detailed guide to cancelling Apple subscriptions here.

Step 3: The Mandate Hunt

This is the final and most important step for Indian users. Check your UPI apps for active AutoPay mandates.

• In GPay/PhonePe/Paytm: Look for a section named "AutoPay" or "UPI Automatic Payments" in your profile or settings. Review the 'Active' mandates list.

Crucial Tip: If you can't find it in the app, the ultimate source of truth is your bank's app. Log in and find the "Mandates" section to see and revoke everything.

Part 3: The Case Study - A Real-World Victory

Theory is one thing, but what does this look like in practice? We put our own 3-step system to the test. Here's how one of our team members audited their own finances and the shocking results they found.

"I thought I was on top of my finances. I was wrong. After just one hour of auditing, I found five subscriptions I had completely forgotten about, silently draining my account every month. The total was staggering."

Here is the breakdown of the forgotten subscriptions and the money saved:

| Subscription Type | Monthly Cost | Status |

|---|---|---|

| Ambitious Fitness App | ₹1,499 | CANCELLED |

| 'Pro' Creative Tool | ₹1,199 | CANCELLED |

| Premium News Subscription | ₹999 | CANCELLED |

| Unused OTT Platform | ₹499 | CANCELLED |

| Extra Cloud Storage | ₹130 | CANCELLED |

| Total Monthly Savings | ₹4,326 | Annual Savings: ₹51,912 |

This isn't an exaggeration. This is real money that was being wasted on zero value. This experience is the very reason CancelMates was born. You can read the full, detailed story of how we found and cancelled these 5 subscriptions here.

Part 4: The Ultimate Weapon - Never Get Trapped Again

Manually auditing your finances once a year is powerful, but it's a chore. You get busy, and the leaks start again. The ultimate strategy is to automate your defense and have a system that works for you 24/7.

Introducing CancelMates: Your Personal Finance Watchdog

Our free tool is designed to be the single source of truth for all your recurring payments. It consolidates everything into one simple dashboard, tracks all your renewal dates, and sends you a smart reminder 3 days before you get charged. You are always in control, and you never waste a single rupee on a service you don't use.

Get Your Free CancelMates Dashboard Now6. The Ultimate FAQ: Every Question, Answered

Q: Where is the best place to start looking for my subscriptions?

A: The single most effective place to start is your primary credit card or bank account statement. It is the ultimate record of where your money is actually going. Download the last 3 months and scan it carefully for any recurring charges you don't recognize.

Q: What is the difference between cancelling a UPI mandate and cancelling the subscription?

A: This is a critical distinction. Cancelling the UPI AutoPay mandate only stops the payment. It does not cancel your service agreement with the company. To fully close your account and avoid "past due" notices, you should always log in to the merchant's website or app and cancel your subscription there as well.

Q: Can I get a refund for a subscription I forgot to cancel?

A: Generally, no. Most companies have a strict no-refund policy for past charges, even if you didn't use the service. Your best bet is to cancel before the next renewal date. This is why getting a reminder is so important.

Q: What is the single easiest way to manage subscriptions?

A: For future subscriptions, the easiest method is to subscribe through a centralized platform like the Apple App Store or Google Play Store whenever possible. Both provide a single, easy-to-use interface to view and cancel all your app-based subscriptions with one or two taps.