Indian Subscription Spending Report 2025 - Why Your Wallet Is Leaking (And How To Fix It)

By Amandeep Singh

Founder, CancelMates. Helping India take control of subscription chaos.

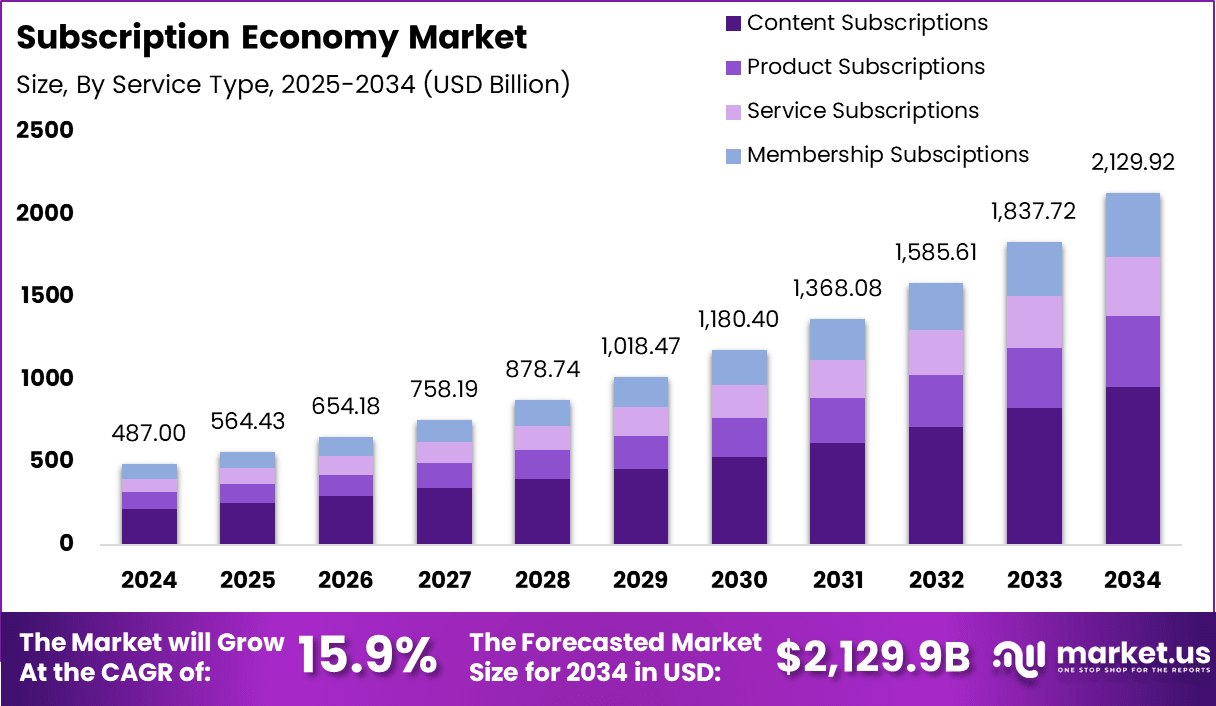

India is experiencing a massive subscription boom — from Netflix to niche fitness apps, monthly charges are everywhere. But with growth comes “subscription fatigue.” This 2025 Indian Subscription Spending Report breaks down key numbers, consumer impact, and how you can stop money leaks before they drain your wallet.

Table of Contents

1. Executive Summary

- Active internet users (2025): 900M+

- OTT market size (2023): ₹17,496 crore

- OTT market projection (2028): ₹35,062 crore (CAGR ~14.9%)

- UPI transactions (2023): 117B+ — recurring payments are now effortless

2. The 3 Forces Driving Subscription Growth

- Massive internet adoption: Over 900M users entering the subscription economy.

- Frictionless payments: UPI autopay + saved cards make subscribing easier than ever.

- Explosion of content & apps: OTT, fitness, learning, SaaS, and niche apps flood the market.

3. OTT — India’s Biggest Subscription Category

OTT (Over-The-Top streaming) is the single largest contributor to subscription spending. With ad-free (SVOD) models dominating and new players entering every year, this sector is expected to nearly double by 2028.

| Metric | Value |

|---|---|

| OTT Market (2023) | ₹17,496 crore |

| OTT Market (2028 est.) | ₹35,062 crore |

| SVOD share (2028 est.) | 65% |

4. The Consumer Impact: Subscription Leaks

- Forgotten renewals: Trials that quietly convert to monthly charges.

- Duplicate services: Families paying for 2–3 similar OTT apps.

- No visibility: No single dashboard to view all active recurring charges.

5. Practical Steps to Take Back Control

- Audit UPI & card statements monthly.

- Cancel anything unused in the last 30 days.

- Prioritize only the subscriptions you actively use.

- Use a tool like CancelMates to automate tracking & reminders.

Never Pay for Unused Subscriptions Again

CancelMates finds, tracks, and reminds you of all subscriptions — before they renew. Save thousands every year with one simple dashboard.

Try CancelMates Free7. Quick Infographic & Highlights

- India’s internet users cross 900M+ in 2025.

- OTT market to nearly double by 2028 → ₹35,000+ crore.

- UPI makes recurring payments seamless → also easier to forget.

- One forgotten subscription can cost you ₹3,000+ annually.